India’s fashion e-commerce sector has transitioned from an introductory phase into a period of high-velocity scaling. This shift necessitates a fundamental recalibration of how value is created and protected within the ecosystem.

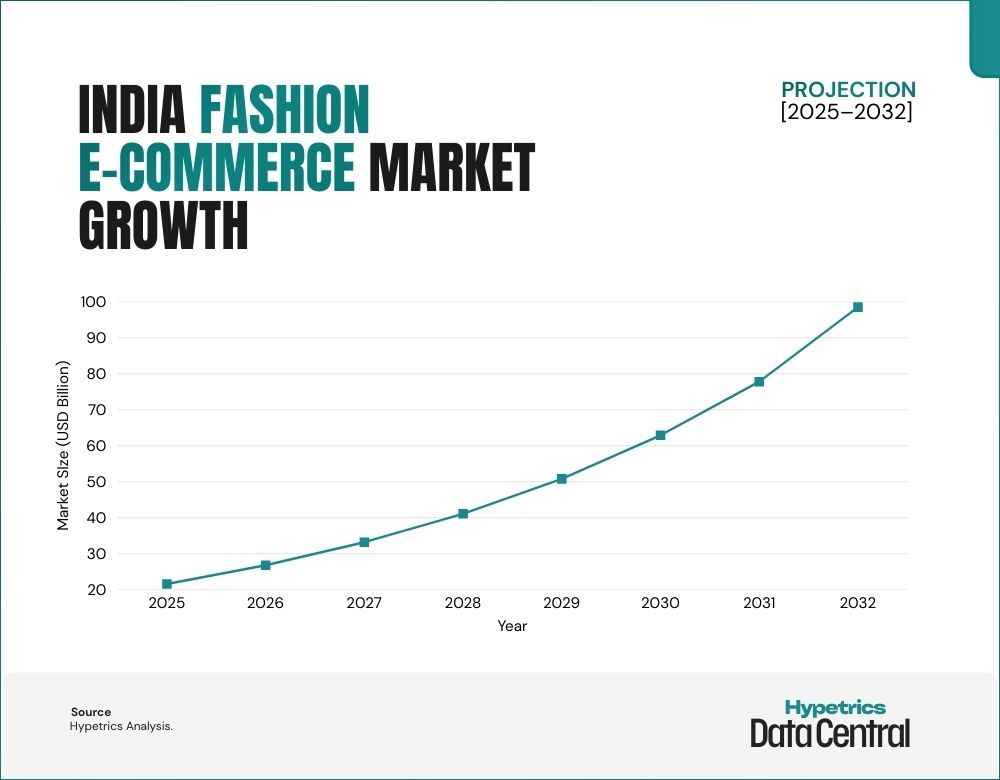

Statistical projections indicate that the market will expand from $21.6 billion in 2025 to $98.5 billion by 2032. This represents a 24.2% Compound Annual Growth Rate (CAGR), positioning fashion as one of the most significant growth drivers within India’s broader consumer internet economy. However, as the market approaches a $100 billion valuation, the primary challenge for stakeholders shifts from demand generation to operational efficiency and margin protection.

The Maturation of the Growth Curve

The projected near five-fold expansion over seven years signals a structural transition in market dynamics. While early-stage growth was driven by mobile penetration and logistics expansion, the 2025–2032 period will be defined by the maturation of consumer behavior and unit economics.

| Market Phase | Primary Drivers | Key Success Metrics |

|---|---|---|

| Expansion Phase (Current) | High Discounts, Delivery Speed, New User Acquisition | Gross Merchandise Value (GMV), Monthly Active Users (MAU) |

| Scale Phase (2025-2032) | Experience Quality, Fit Accuracy, Customer Retention | Contribution Margin, Return Rates, Lifetime Value (LTV) |

Returns as a Non-Linear Risk Factor

Data suggests that fashion e-commerce maintains structurally higher return rates than other retail categories, typically ranging between 25% and 40%. At scale, the economic impact of these returns scales non-linearly, transitioning from a manageable operational cost to a systemic risk.

The primary drivers of return-related losses include:

- Reverse Logistics Costs: The high capital expenditure required to process, inspect, and restock returned items.

- Inventory Depreciation: Slower inventory turnover cycles leading to seasonal markdowns.

- Erosion of Brand Equity: Repeated post-purchase dissatisfaction impacting long-term retention.

At a $98.5 billion market size, a reduction of even 1–2 percentage points in avoidable returns represents billions of dollars in unlocked EBITDA.

Experience Infrastructure as a Margin Guard

The growth trajectory implies that competitive advantage is shifting from the physical supply chain to the digital experience layer. Investments in experience-driven tools are no longer viewed as conversion optimizers but as critical infrastructure for protecting margins.

Strategic focus areas for the 2032 horizon include:

- Precision Fit Tools: Leveraging data to align product specifications with consumer anatomy.

- Contextual Personalization: Using predictive analytics to reduce “expectation mismatch.”

- Decision Intelligence: Improving consumer confidence at the pre-checkout stage to lower post-purchase friction.

The Indian fashion e-commerce market is approaching a threshold where surface-level optimizations are insufficient to sustain profitability. The rise to $98.5 billion serves as a critical signal for the industry: as the volume of transactions increases, the cost of inefficiency becomes prohibitive.

The upcoming cycle will reward entities that prioritize decision confidence over sheer logistics speed. In an environment defined by a 24.2% CAGR, “Experience Infrastructure” becomes the primary mechanism for decoupling revenue growth from operational waste.