Quick commerce in India has evolved from a convenience-led experiment into a core retail channel for urban consumers. While most analysis focuses on overall category growth and delivery speed, time-based consumption behaviour remains underexplored.

Post-9 PM ordering patterns reveal a distinct consumer mindset. Unlike daytime usage, which includes routine grocery replenishment and exploratory browsing, late-night quick commerce reflects urgency-driven decision-making shaped by immediacy, limited alternatives, and situational needs.

This report examines what consumers buy most on quick commerce platforms after 9 PM and what this behaviour signals about the role of quick commerce in India’s daily consumption cycle.

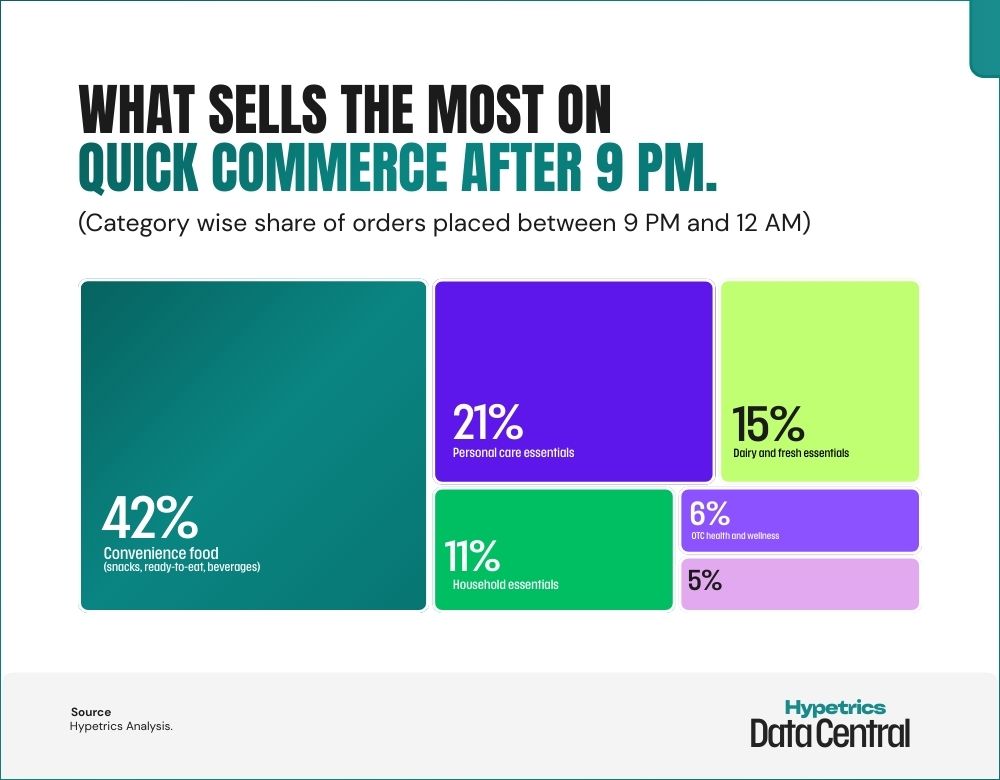

Category-wise Order Distribution After 9 PM

Data from quick commerce platform dashboards and category-level disclosures indicates a clear concentration of demand across a narrow set of categories during late-night hours.

Category share of orders placed between 9 PM and 12 AM:

- Convenience food including snacks, ready-to-eat meals, beverages: 42%

- Personal care essentials such as hygiene and grooming products: 21%

- Dairy and fresh essentials: 15%

- Household essentials: 11%

- OTC health and wellness products: 6%

- Other categories combined: 5%

Convenience food alone accounts for more than two-fifths of late-night orders, making it the dominant driver of post-9 PM quick commerce demand.

How Late-Night Demand Differs From Daytime Usage

Late-night ordering patterns differ materially from daytime behaviour across three dimensions.

First, basket composition.

After 9 PM, baskets are narrower and more focused. Consumers prioritise items that offer immediate utility or consumption. Categories that require comparison, size selection, or extended browsing see significantly lower traction.

Second, basket value and frequency.

Late-night orders tend to be lower in average order value but higher in frequency. Consumers are less price-sensitive at this hour, placing smaller orders to solve immediate needs rather than planning consolidated purchases.

Third, intent.

Daytime quick commerce often complements planned grocery runs. Late-night usage functions as a substitute for closed stores, delayed plans, or unexpected requirements. The platform becomes a utility rather than a marketplace.

Why Convenience Food Dominates Late-Night Orders

The dominance of convenience food reflects a combination of behavioural and structural factors.

Late evenings coincide with post-dinner consumption, work fatigue, social gatherings, and unplanned hunger. At this stage, consumers prioritise speed and certainty over variety. Ready-to-eat items, packaged snacks, and beverages align directly with this need state.

Additionally, these products carry fewer decision variables. There is minimal need for comparison, low perceived risk, and immediate consumption value. This makes them ideal for rapid decision-making in low-attention time windows.

The Role of Personal Care and Essentials

Personal care and essential replenishment categories form the second largest block of late-night demand.

These purchases are typically driven by urgency rather than preference. Items such as sanitary products, grooming essentials, baby care, and basic hygiene products are often needed immediately and cannot be deferred to the next day.

Their presence highlights that late-night quick commerce is not limited to indulgence. It also functions as a reliability layer for households managing unexpected or time-sensitive needs.

Operational Signals for Brands and Platforms

Late-night demand patterns carry operational implications.

- SKU performance after 9 PM favours fast-moving, low-complexity products

- Depth of assortment matters less than availability and fulfilment speed

- Packaging, pricing, and visibility strategies need to be time-sensitive

- Night-time demand does not mirror daytime category priorities

Brands optimising solely for average daily performance risk missing this distinct consumption window.

Late-night quick commerce usage reflects a utility-first consumption mindset. After 9 PM, consumers are not exploring options or discovering brands. They are solving immediate problems. The concentration of demand around convenience food and essential categories reinforces that quick commerce, during this window, functions less as a retail marketplace and more as an on-demand service layer.

Understanding this behavioural shift is critical for accurately interpreting quick commerce growth metrics. Aggregate category performance masks meaningful time-based differences in consumer intent, basket structure, and decision-making speed.

As quick commerce matures, time-of-day behaviour will increasingly shape assortment strategy, inventory planning, and category economics.

Source and Methodology

This analysis is based on aggregated insights from quick commerce platform public dashboards, category-level disclosures, and industry reporting, supplemented by Hypetrics analysis. Percentages represent indicative order share distribution and are intended to highlight directional patterns rather than precise volume figures.