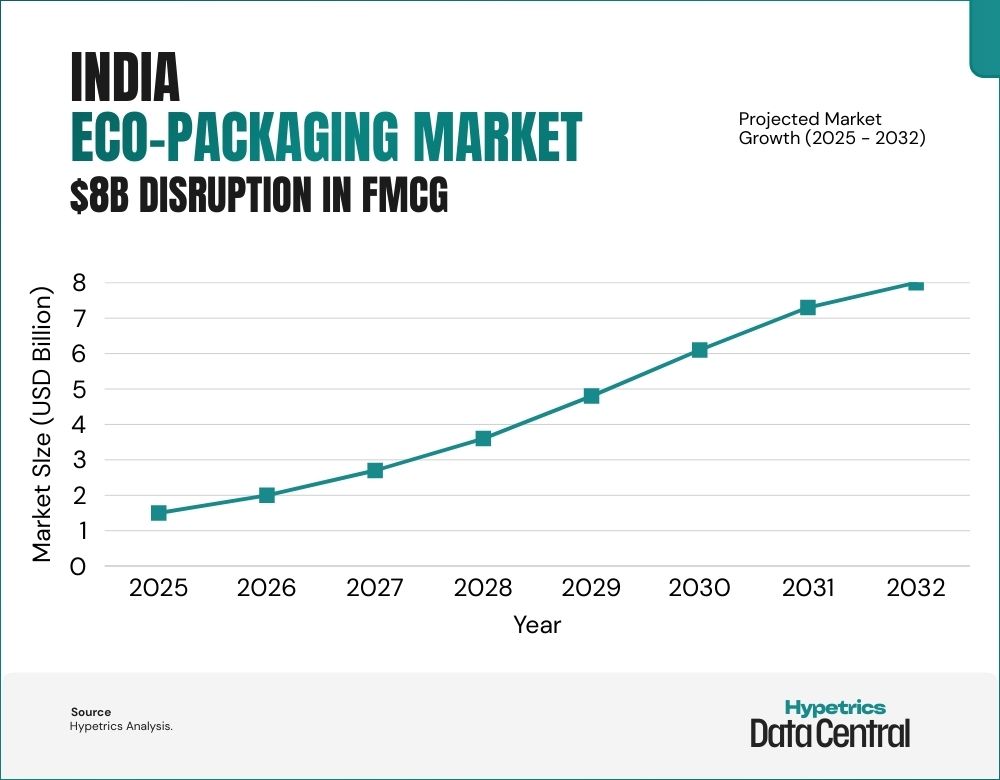

The Indian packaging landscape is currently undergoing a fundamental decoupling from its traditional reliance on virgin polymers and non-recyclable multi-layered plastics (MLP). What was once a localized conversation regarding corporate social responsibility has evolved into a high-stakes infrastructure and procurement challenge. As of early 2026, the India sustainable packaging market is valued at approximately $1.25 billion. However, predictive modeling suggests a trajectory toward $7.4–9.2 billion by 2032.

This report analyzes the data intelligence, regulatory pressures, and material science shifts driving this 30% annual growth rate.

Macro-Economic Context: From Linear to Circular

For decades, India’s FMCG and e-commerce sectors prioritized “cost-per-unit” over “end-of-life” utility. This linear model (Produce-Use-Discard) is being dismantled by a combination of fiscal penalties and supply chain volatility.

The transition to sustainable packaging is now viewed through the lens of Risk Mitigation. Companies that fail to transition by 2028 face significant “Environmental Compensation” (EC) levies under the updated Plastic Waste Management (PWM) framework. Consequently, capital expenditure (CapEx) is shifting toward domestic recycling plants and bio-polymer R&D.

Material Intelligence: The 2032 Revenue Mix

The market is not a monolith; it is a fragmented ecosystem of competing technologies. By 2032, the revenue distribution will reflect the maturity of India’s waste-collection infrastructure.

A. Recyclable Paper and Cellulose-Based Board (Projected Share: 38%)

Paper remains the primary beneficiary of the anti-plastic sentiment. India’s paper industry is investing heavily in “Barrier Coating” technology. Traditionally, paper could not hold liquids or oils without a plastic lining. New aqueous-based coatings allow for 100% recyclability while maintaining grease resistance.

- Intelligence Insight: Large-scale conversion of corrugated box plants into specialized eco-packaging hubs is driving this segment.

B. Compostable and Biodegradable Polymers (Projected Share: 24%)

This segment includes PLA (Polylactic Acid) and PBAT. While currently reliant on expensive imported resins, the 2026–2028 period will see the commissioning of three major domestic bio-refineries in India.

- Constraint: The growth of this segment is tied strictly to the expansion of industrial composting facilities, which currently lag behind production.

C. Post-Consumer Recycled (PCR) Plastics (Projected Share: 21%)

The “Mandatory Content” rules are the engine here. By 2026, rigid packaging must contain a minimum percentage of recycled content. This has turned “trash” into a commodity.

- Data Point: The price of high-grade PCR flakes has risen by 18% year-on-year, reflecting a demand-supply mismatch that is attracting heavy private equity investment.

D. Reuse and Refillable Ecosystems (Projected Share: 11%)

Mainly concentrated in urban Tier-1 cities, the “Packaging-as-a-Service” model (reusable glass or high-grade steel) is gaining traction in the home-care and personal-care segments.

The Regulatory Engine: EPR and the 2026 Compliance Cliff

The Extended Producer Responsibility (EPR) framework is the single most powerful driver of this market. In 2026, we have reached a “Compliance Cliff” where the Ministry of Environment, Forest and Climate Change (MoEFCC) has digitized the tracking of plastic credits.

- The EPR Credit Market: Much like carbon credits, companies that over-achieve their recycling targets can sell credits to laggards. This has created a secondary financial market worth hundreds of millions of dollars.

- Category-Specific Targets: * Category I (Rigid Plastic): 70% recycling target for 2026–27.

- Category II (Flexible Plastic): 50% recycling target, focusing on replacing MLPs with mono-materials.

- Category III (Multi-layered Plastic): Facing the highest penalties, forcing brands toward paper-based laminates.

Procurement Dynamics: The “Green Premium” Compression

In 2024, sustainable packaging cost 25–40% more than conventional options. By 2026, this “Green Premium” has compressed to 12–18% for high-volume buyers.

Factors Driving Cost Parity:

- Economies of Scale: As the “Big Four” FMCG players in India move 100% of their soap and detergent portfolios to recyclable formats, the cost of specialized resins drops.

- Taxation Incentives: Preferential GST (Goods and Services Tax) treatments for certified compostable materials are being discussed to further bridge the price gap.

- Reverse Logistics Optimization: Brands are partnering with “Aggregators” (startups that organize rag-pickers and waste dealers) to secure their own supply of PCR, bypassing volatile open-market prices.

The Export Imperative: Global Compliance as a Domestic Catalyst

India is a global manufacturing hub for pharmaceuticals and textiles. Both sectors are facing intense pressure from the EU Green Deal and the US Plastic Pollution Prevention Act.

- Pharma Packaging: Blister packs are moving toward “Cold Form” aluminum or recyclable PP (Polypropylene) to meet European waste directives.

- Textile Packaging: The shift from LDPE polybags to FSC-certified paper mailers is almost complete for exporters. This “Export-First” adoption is trickling down to domestic supply chains, as manufacturers prefer maintaining a single, compliant production line rather than two separate ones.

Technical Barriers and Structural Bottlenecks

Despite the optimistic $9 billion forecast, the market faces three “Hard Stops” that require urgent intervention:

A. The Monolayer Challenge

Most snack packaging in India uses Multi-Layered Plastic (MLP) for shelf-life (oxygen and moisture barriers). Switching to a “Mono-material” (all one type of plastic) is easy for recycling but difficult for food preservation. Engineering a mono-PE film that keeps chips crispy for six months is the “Holy Grail” of current Indian R&D.

B. Waste Fragmenting

India’s waste is “wet.” Contamination of dry packaging waste by organic food waste reduces the quality of PCR. Until municipal-level source segregation hits 80% (currently estimated at 45–50% in major hubs), the cost of cleaning waste for recycling remains a significant drag on margins.

C. Testing and Certification

There is a proliferation of “Fake Green” products. Labs like the Indian Institute of Packaging (IIP) are currently overwhelmed with a backlog of companies seeking “Compostability” certifications.

Sector-Specific Deep Dives

E-Commerce & Logistics

E-commerce players (Amazon, Flipkart, Zepto) have been the earliest adopters of plastic-free secondary packaging. The use of honeycomb paper, shredded cardboard fillers, and water-activated tape has replaced bubble wrap and plastic tape in 90% of Tier-1 shipments.

Food Service & Delivery

The “Cloud Kitchen” explosion has created a massive demand for bagasse (sugarcane fiber) containers. This sub-sector is growing at 35% CAGR, the fastest within the ecosystem, as consumers directly associate plastic containers with health risks (microplastics).

Investor Intelligence: Where the Capital is Flowing

Venture Capital and Private Equity are moving away from “Brand-side” sustainability and into “Infrastructure-side” solutions:

- Sorting Technology: AI-based optical sorters that can distinguish between different polymer grades at high speeds.

- Chemical Recycling: Startups focused on “Depolymerization”—breaking plastic back down into oil—to handle waste that mechanical recycling cannot.

- Alternative Feedstocks: Using agricultural residue (stubble) to create paper pulp, solving both the packaging and the “Stubble Burning” pollution crisis simultaneously.

The 2032 Landscape

By 2032, the concept of “Sustainable Packaging” will likely disappear—not because the movement failed, but because it became the industrial default.

The projected $7–9 billion market value represents a complete re-tooling of the Indian manufacturing base. Companies that have integrated EPR compliance into their core financial planning are already seeing lower capital costs (via ESG-linked loans). In contrast, companies relying on legacy plastic formats are seeing their “Total Cost of Ownership” rise as landfill taxes and plastic credits become more expensive.

The data suggests that the next 72 months will be a period of “The Great Packaging Consolidation,” where small-scale plastic converters will either pivot to eco-materials or be absorbed by larger, tech-enabled circular economy firms.